What is model risk?

Using financial models comes with a degree of risk. When an organization uses a model, the term ‘model risk’ simply refers to the potential losses that may be incurred due to errors in development or use of the model in question.

The information that goes into the creation of the model will have some bearing on the degree of risk that the end result could be exposed to. Along with economic and statistical theories and calculations, financial models all, to some extent, rely on assumptions (that aren’t always accurate). Other potential risk factors include the use of inaccurate information, human error, technical errors and problems in the programming of the model itself.

Model Risk Management frameworks

Financial institutions have come under increasing scrutiny from regulatory bodies about their use of models. Consequently, it is more important than ever that model risks are managed effectively. As such, developing a model risk management framework is fast becoming common practice. With a strong framework in place, institutions can vastly improve the efficiency and governance of financial models, helping to avoid errors, losses and reputational harm. But, how are businesses ensuring their risk management is up to scratch?

Manual processes aren’t enough for model governance

Our powerful Model Risk Management (MRM) capabilities allow financial institutions to carry out MRM initiatives quickly, efficiently, and effectively.

Institutions need a flexible, dynamic, and effective MRM solution that can evolve in step with their requirements and business. Uniquely, ClusterSeven MRM covers a range of model environments and the tools and calculators that feed them, providing a powerful, flexible, cost-effective MRM for any institution, whether you’re using models to manage the business, develop new products, or to comply with regulations like SR11-7 and SS 3/18 or initiatives like the UK’s Operational Resilience.

Lighten the pressures and cut your costs

Model applications are typically managed manually, putting modeling teams under pressure to verify accuracy and manage change documentation, generate reports and provide the transparency and enhanced service that management and regulators demand – all with limited time and budget. But as noted in our white paper with Chartis Research, this demand for model transparency will only continue to increase and organizations need to be prepared.

By automating model governance, ClusterSeven MRM helps mitigate risk and support compliance at an entirely new level, while delivering efficiency and precision no manual process can even approach.

Build a central inventory of models, tools & calculators

Identify, analyze and manage your models, tools, and calculators in a centralized enterprise-wide model inventory.

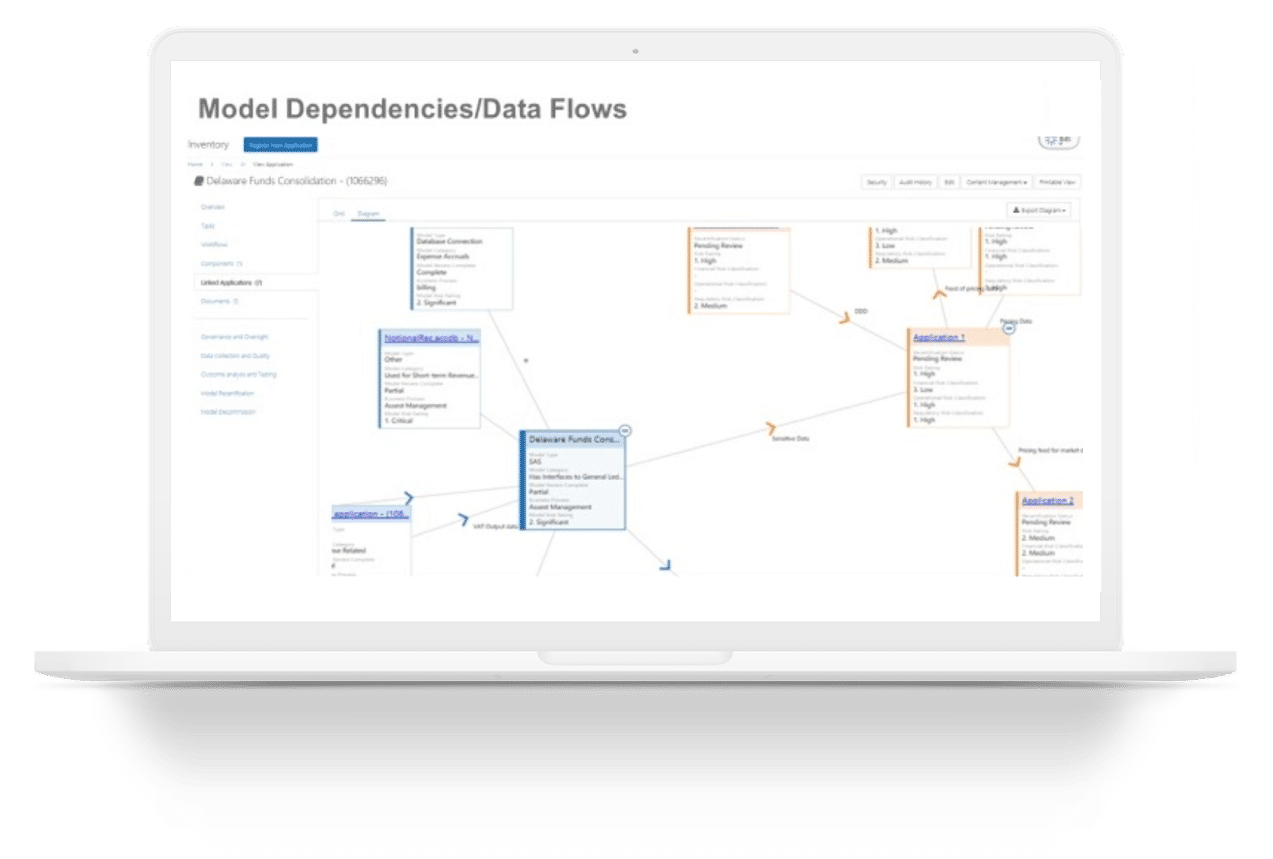

Our platform is designed with a highly configurable view, comprehensive document storage, and powerful data connection mapping functions. These allow you to quickly deploy a model risk management solution without the need for custom development.

Document & track models throughout their lifecycle

Build an automated model risk management workflow and task management process utilizing our proactive monitoring and alerting capabilities.

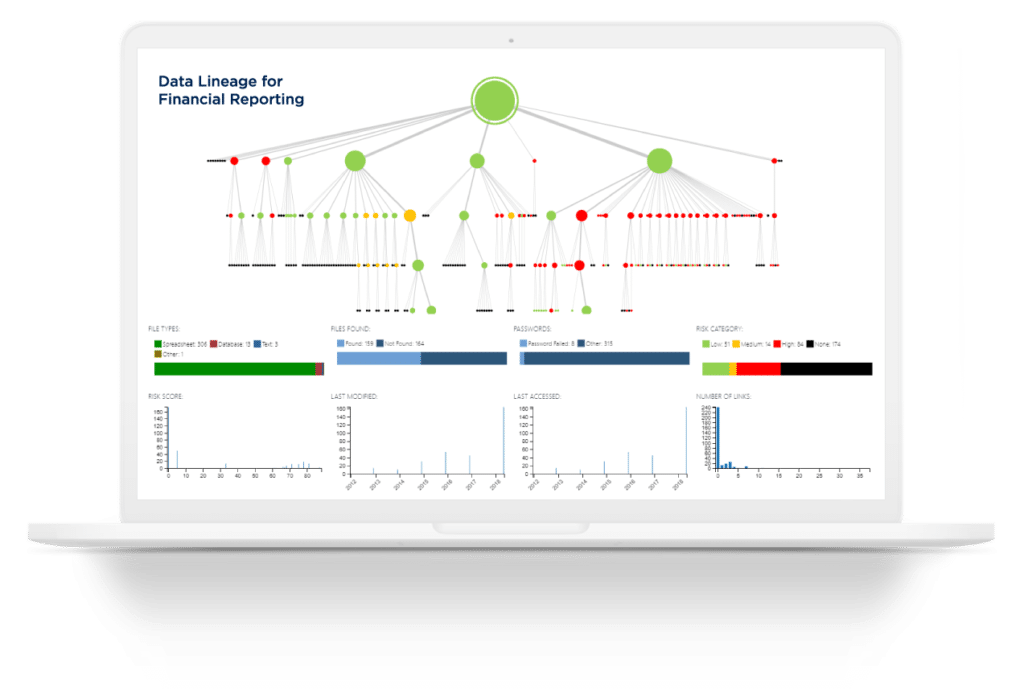

Simply and quickly define attributes, workflows, reports, screen layouts, algorithms, risk checks, data flows and lineage. Capture the structure and complexity of your models, tools and calculators.

Gain confidence with role-based security & full audit trails

Get a complete audit trail of updates and interactions with your model risk management framework, allowing you to understand your model risk. Define roles and access to the platform giving you full role-based security management, delivering increased transparency with an enterprise-wide view.

Enterprise-wide model risk management

ClusterSeven MRM is a uniquely comprehensive solution for managing model risk by helping your modeling team better understand the capabilities and limitations of models. This lets you use models more effectively with problems and inefficiencies spotted earlier and more easily, and thus improving your business-critical models.

Sophisticated, automated risk management models not only satisfy regulators but also streamline workflow and are more cost-effective, thanks to time savings and reduced financial losses. Plus, they allow better business judgments to be made through increased model transparency.

Who’s using ClusterSeven?

Click on the client logos below to see each Case Study.

Discover ClusterSeven Model Risk Manager

Learn more about how to manage the spreadsheets and potential risk hidden across your organization.